Journal Name: Scholar Journal of Applied Sciences and Research

Article Type: Research

Received date: 18 June, 2019

Accepted date: 24 June, 2019

Published date: 30 June, 2019

Citation: Ngoc Huy DT (2019) The Volatility of Market Risk of Viet Nam Stock Investment Industry after the Low Inflation Period 2015-2017. Sch J Appl Sci Res Vol: 2, Issu: 8 (19-25).

Copyright: © 2019 Ngoc Huy DT. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Abstract

The Vietnam economy has obtained lots of achievements after the financial crisis 2007-2011, until it reached a low inflation rate of 0.6% in 2015. Vietnam stock investment industry are growing and contributing much to the economic development and has been affected by inflation. High and increasing inflation might reduce values of insurance contracts. This paper measures the volatility of market risk in Viet Nam stock investment industry after this period (2015-2017). The main reason is the necessary role of the insurance company system in Vietnam in the economic development and growth in recent years always go with risk potential and risk control policies.

This research paper aims to figure out how much increase or decrease in the market risk of Vietnam stock investment firms during the post-low inflation environment 2015-2017 (Table 1).

First, by using quantitative combined with comparative data analysis method, we find out the risk level measured by equity beta mean in the insurance industry is acceptable, as it is lower than (<) 1.

Then, one of its major findings is the comparison between risk level of stock investment industry during the financial crisis 2007-2009 compared to those in the post-low inflation time 2015-2017. In fact, the research findings show us market risk level during the post-low inflation time has decreased much.

Finally, this paper provides some ideas that could provide companies and government more evidence in establishing their policies in governance. This is the complex task, but the research results show us warning that the market risk need to be controlled better during the post-low inflation period 2015-2017. And our conclusion part will recommend some policies and plans to deal with it.

JEL classification numbers: G010, G390

Keywords: Risk management; Asset beta; Financial crisis; Stock investment industry; Policy

Abstract

The Vietnam economy has obtained lots of achievements after the financial crisis 2007-2011, until it reached a low inflation rate of 0.6% in 2015. Vietnam stock investment industry are growing and contributing much to the economic development and has been affected by inflation. High and increasing inflation might reduce values of insurance contracts. This paper measures the volatility of market risk in Viet Nam stock investment industry after this period (2015-2017). The main reason is the necessary role of the insurance company system in Vietnam in the economic development and growth in recent years always go with risk potential and risk control policies.

This research paper aims to figure out how much increase or decrease in the market risk of Vietnam stock investment firms during the post-low inflation environment 2015-2017 (Table 1).

First, by using quantitative combined with comparative data analysis method, we find out the risk level measured by equity beta mean in the insurance industry is acceptable, as it is lower than (<) 1.

Then, one of its major findings is the comparison between risk level of stock investment industry during the financial crisis 2007-2009 compared to those in the post-low inflation time 2015-2017. In fact, the research findings show us market risk level during the post-low inflation time has decreased much.

Finally, this paper provides some ideas that could provide companies and government more evidence in establishing their policies in governance. This is the complex task, but the research results show us warning that the market risk need to be controlled better during the post-low inflation period 2015-2017. And our conclusion part will recommend some policies and plans to deal with it.

JEL classification numbers: G010, G390

Keywords: Risk management; Asset beta; Financial crisis; Stock investment industry; Policy

Introduction

Throughout many recent years (2006 until now), Viet Nam stock investment market is evaluated as one of active markets, which has certain positive effect for the economy and become one of vital players in the financial system of the nation.

Stock investment companies have been affected by inflation (see more in the below conceptual theories part).

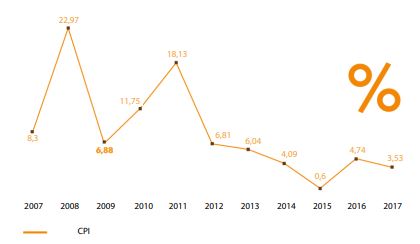

Generally speaking, central banks aim to maintain inflation around 2% to 3%. Increases in inflation significantly beyond this range can lead to possible hyperinflation, a devastating scenario in which inflation rises rapidly out of control, and therefore harm the insurance industry. Looking at figure 1, we can see the Vietnam economy has controlled inflation well.

This study will calculate and figure out whether the market risk level during the post-low inflation time (2015) has increased or decreased, compared to those statistics in the financial crisis time (2007-2009).

The paper is organized as follows: after the introduction it is the research issues, literature review, conceptual theories and methodology. Next, section 3 will cover main research findings/results. Section 4 gives us some risk analysis, then section 5 presents discussion and conclusion and policy suggestion will be in the section 6.

Research Issues

The scope of this study are:

Issue 1: Whether the risk level of stock investment firms under the different changing scenarios in post-low inflation period 2015-2017 increase or decrease so much, compared to in financial crisis 2007-2009 and?

Issue 2: Because Viet Nam is an emerging and immature financial market and the stock market still in the starting stage, whether the dispersed distribution of beta values become large in the different changing periods in the stock investment industry.

| Risk level (equity beta) | Risk level (asset beta) | Other measures | Gap | |

|---|---|---|---|---|

| Post – low inflation period | Scenario … | Scenario … | Scenario … | Analysis |

| Financial crisis time |

Table 1: Analyzing market risk under two (2) scenarios: post – low inflation period 2015-2017 compared to the financial crisis 2007-2009.

Figure 1: Inflation, CPI over past 10 years (2007-2017) in Vietnam.

Literature review

Next, Martin and Sweder [1] pointed out that incentives embedded in the capital structure of banks contribute to systemic fragility, and so support the Basel III proposals towards less leverage and higher loss absorptioncapacityof capital. Najeb [2] suggested a positive relationship between efficient stock markets and economic growth, both in short run and long run and there is evidence of an indirect transmission mechanism through the effect of stock market development on investment.

Yener et al. [3] found evidence that unusually low interest rates over an extended period of time contributed to an increase in banks’ risk.

Emilios [4] mentioned that bank leverage ratios are primarily seen as a microprudential measure that intends to increase bank resilience. Yet in today’s environment of excessive liquidity due to very low interest rates and quantitative easing, bank leverage ratios should also be viewed as a key part of the macroprudential framework. As such, it explains the role of the leverage cycle in causing financial instability and sheds light on the impact of leverage restraints on good bank governance and allocative efficiency.

Atousa and Shima [5] found out the econometric results indicate that life insurance sector growth contributes positively to economic growth. Then, Gunarathna [6] revealed that financial leverage positively correlate with financial risk. However, firm size negatively affects the financial risk.

Aykut [7] suggested two main findings: (i) Credit risk and Foreign exchange rate have a positive and significant effect, but interest rate has insignificant effect on banking sector profitability, (ii) credit and market risk have a positive and significant effect on conditional bank stock return volatility.

Last but not least, Riet [8] mentioned that after the euro area crisis had subsided, the Governing Council of the ECB still faced a series of complex and evolving monetary policy challenges. As market volatility abated, but deflationary pressures emerged, the main task as from June 2014 became to design a sufficiently strong monetary stimulus that could reach market segments that were deprived of credit at reasonable costs and to counter the risk of a too prolonged period of low inflation. Hami [9] showed that inflation has a negatively significant effect on financial depth and also positively significant effect on the ratio of total deposits in banking system to nominal GDP in Iran during the observation period.

Finally, Chizoba et al. [10] revealed that inflation rate had a positive but insignificant effect on insurance penetration of the Nigerian insurance industry. The implication is that the macroeconomic variable (inflation) increase the level of insurance penetration in Nigerian insurance industry but it increase was not significant. And Miguel et al. [11] found a consistently negative and nonlinear effect of price increases on financial variables; in particular, it is statistically significant in the full sample of countries, significant in developing countries, and insignificant in developed countries [12].

Conceptual theories

Positive sides of low inflation:Low (not negative) inflation reduces the potential of economic recession by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. This is explaining why many economists nowadays prefer a low and stable rate of inflation. It will help investment, encourage exports and prevent boom economy [13]. The central bank can use monetary policies, for instance, increasing interest rates to reduce lending, control money supply or the Ministry of finance and the government can use tight fiscal policy (high tax) to achieve low inflation.

Negative side of low inflation: it leads to low aggregate demand and economic growth, recession potential and high unemployment. Production becomes less vibrant. Low inflation makes real wages higher. Workers can thus reduce the supply of labor and increase rest time. On the other hand, low product prices reduce production motivation. The central bank might consider using monetary policy to stimulate the economic growth during low-inflation environment. It means that an expansionary monetary policy can be used to increase the volume of bank loans to stimulate the economy [14-18].

Financial and credit risk in the bank system can increase when the financial market becomes more active and bigger, esp. with more international linkage influence. Hence, central banks, commercial banks, organizations and the government need to organize data to analyze and control these risks, including market risk.

For the insurance industry, high inflation may harm the insurance companies and cause higher losses and increase the operational costs. In case of low inflation, interest rates may fall and hence, it is not a benefit for insurers’ investment portfolio. Hence, risk assessment and control mechanisms are necessary for insurers to reduce these losses [19].

| 2015-2017 (post - low inflation) | ||||

|---|---|---|---|---|

| Order No. | Company stock code | Equity beta | Asset beta (assume debt beta=0) | Note |

| 1 | AGR | 0.911 | 0.835 | assume debt beta=0; debt ratio as in F.S 2015 |

| 2 | APG | 0.333 | 0.294 | |

| 3 | APS | 0.821 | 0.621 | |

| 4 | AVS | |||

| 5 | BSI | 0.602 | 0.219 | |

| 6 | BVS | 0.590 | 0.406 | |

| 7 | CLS | |||

| 8 | CTS | 0.781 | 0.586 | |

| 9 | SHS | 1.104 | 0.338 | |

| 10 | VNR | -0.169 | -0.069 | |

Table 2: The Volatility of Market Risk (beta) of Stock investment Industry in the post- low inflation environment 2015-2017.

| 2015-2017 (post - low inflation) | ||

|---|---|---|

| Statistic results | Equity beta | Asset beta (assume debt beta=0) |

| MAX | 1.104 | 0.835 |

| MIN | -0.169 | -0.069 |

| MEAN | 0.622 | 0.404 |

| VAR | 0.1559 | 0.0772 |

| Note: Sample size : 8 (We just take a sample of 8 firms to make comparison) | ||

Table 3: The Statistics of Volatility of Market Risk (beta) of Stock investment Industry in the post- low inflation environment 2015-2017.

Methodology

We use the data from the stock exchange market in Viet Nam (HOSE and HNX) during the financial crisis 2007-2009 period and the post-low inflation time 2015-2017 to estimate systemic risk results. We perform both fundamental data analysis and financial techniques to calculate equity and asset beta values.

In this study, analytical research method and specially, comparative analysis method is used, combined with quantitative data analysis. Analytical data is from the situation of listed insurance firms in VN stock exchange.

Finally, we use the results to suggest policy for both these enterprises, relevant organizations and government.

Main Results

General data analysis

We get some analytical results form the research sample with 8 listed firms in the stock investment market with the live date from the stock exchange.

Empirical research findings and discussion

In the below section, data used are from total 8 listed stock investment industry companies on VN stock exchange (HOSE and HNX mainly). Different scenarios are created by comparing the calculation risk data between 2 periods: the post-low inflation environment 2015-2017 and the financial crisis 2007-2009.

Market risk (beta) under the impact of tax rate, includes: 1) equity beta; and 2) asset beta. We model our data analysis as given in table 2.

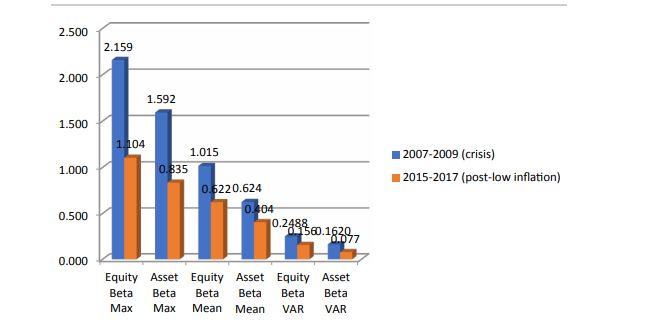

Based on the above calculation result tables 3-6, we analyze data as shown:

Firstly, we see in the table 2, that there is only 1 stock firm (over 8 companies) have equity beta values higher (>) than 1 while there are 7 insurers with beta <1, which means risk level acceptable.

And table 3 provides evidence for us to see that equity beta mean of the sample is 0.622, lower than (<) 1. It is acceptable.

Then, looking at the table 4, we recognize that there is only 1 stock firm with equity beta values > 1 (SHS) in the post-low inflation period 2015-2017, whereas there are 3 stock company (AGR, BSI, BVS) with equity beta values >= 1 in the financial crisis 2007-2009.

Next, table 5 shows that most of the equity and asset beta values in the post- low inflation period are lower (>) than those in the financial crisis 2007-2009. Esp. the figures represent the risk level of 7 over 10 stock firms (AGR, APG, APS, BSI, BVS, CTS, VNR) lower during the post-low inflation period.

Furthermore, table 6 tells us all statistics of equity beta in the post-inflation period 2015-2017 are lower (>) than those in the financial crisis 2007-2009, and there is only one case with negative beta value.

In addition to, looking at the below Figure 2, we can find out:

Values of equity beta max and equity beta mean, as well as equity beta var and asset beta values in the post-low inflation 2015-2017 are much lower (>) than those in the crisis 2007- 2009. Esp, equity beta mean and max are obviously lower. It means that the level of risk in the post-low inflation period 2015-17 is much lower in general and in average.

| 2007-2009 (financial crisis) | 2015-2017 (post - low inflation) | |||||

|---|---|---|---|---|---|---|

| Order No. | Company stock code | Equity beta | Asset beta (assume debt beta=0) | Equity beta | Asset beta (assume debt beta=0) | Note |

| 1 | AGR | 1 | 0.313 | 0.911 | 0.835 | assume debt beta=0; debt ratio as in F.S 2015 and 2008 |

| 2 | APG | 0.648 | 0.63 | 0.333 | 0.294 | |

| 3 | APS | 0.895 | 0.382 | 0.821 | 0.621 | |

| 4 | AVS | 0.546 | 0.425 | 0.000 | 0.000 | |

| 5 | BSI | 1 | 0.873 | 0.602 | 0.219 | |

| 6 | BVS | 2 | 2 | 0.590 | 0.406 | |

| 7 | CLS | 0.662 | 0.331 | 0.000 | 0.000 | |

| 8 | CTS | 0.812 | 0.546 | 0.781 | 0.586 | |

| 9 | SHS | 1.104 | 0.338 | |||

| 10 | VNR | 0.922 | 0.525 | -0.169 | -0.069 | |

Table 4: The Comparison of Volatility of Market Risk (beta) of Stock investment Industry in the post- low inflation environment 2015-2017 and the financial crisis 2007-2009.

| GAP (+/-) 2015-17 compared to 2007-09 | ||||

|---|---|---|---|---|

| Order No. | Company stock code | Equity beta | Asset beta (assume debt beta=0) | Note |

| 1 | AGR | -0.459 | 0.522 | values (2015-17) minus (-) 2007-09 |

| 2 | APG | -0.315 | -0.336 | |

| 3 | APS | -0.074 | 0.239 | |

| 4 | AVS | -0.546 | -0.425 | |

| 5 | BSI | -0.523 | -0.654 | |

| 6 | BVS | -1.569 | -1.186 | |

| 7 | CLS | -0.662 | -0.331 | |

| 8 | CTS | -0.031 | 0.040 | |

| 9 | SHS | N/A | N/A | |

| 10 | VNR | -1.091 | -0.594 | |

Table 5: The Difference between Volatility of Market Risk (beta) of Stock investment Industry in the post- low inflation environment 2015-2017 and the financial crisis 2007-2009.

| 2007-2009 (crisis) | 2015-2017 (post-low inflation) | GAP (+/-) 2015-17 compared to 2007-09 | ||||

|---|---|---|---|---|---|---|

| Statistic results | Equity beta | Asset beta (assume debt beta=0) | Equity beta | Asset beta (assume debt beta=0) | Equity beta | Asset beta (assume debt beta=0) |

| MAX | 2.159 | 1.592 | 1.104 | 0.835 | -1.055 | -0.757 |

| MIN | 0.546 | 0.313 | -0.169 | -0.069 | -0.715 | -0.382 |

| MEAN | 1.015 | 0.624 | 0.622 | 0.404 | -0.394 | -0.220 |

| VAR | 0.2488 | 0.1620 | 0.156 | 0.077 | -0.093 | -0.085 |

| Note: Sample size : 8 | ||||||

Table 6: Statistics of Volatility of Market Risk (beta) of Stock investment Industry in the post- low inflation environment 2015-2017 compared to those in the financial crisis 2007-2009.

Risk Analysis

Inflation can affect negatively on market capitalization, but low inflation could be beneficial to economic recovery and might have benefits for financial system as investors can perform more transactions.

Discussion for Further Researches

We can continue to analyze risk factors behind the risk scene (risk increasing as above analysis) in order to recommend suitable policies and plans to control market risk better. Also, the role of risk management and risk managers need to be developed more.

Conclusion and Policy Suggestion

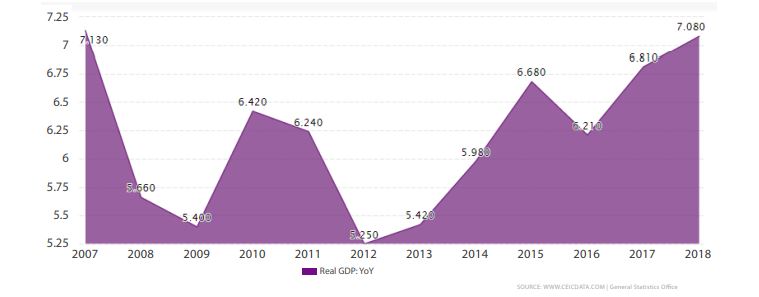

In general, stock investment companies system in Vietnam has been contributing significantly to the economic development and GDP growth rate of more than 6-7% in recent years (Figure 3). The above analysis shows us that most of risk measures (equity beta max, mean and var) are decreasing during the post-low inflation period. However, stock investment company system in Vietnam need to continue increase their corporate governance system, structure and mechanisms, as well as their competitive advantage to control risk better. For instance, stock investment system might consider proper measures and plans to manage bad scenarios in future. Another way is increasing productivity while reducing management or operational costs.

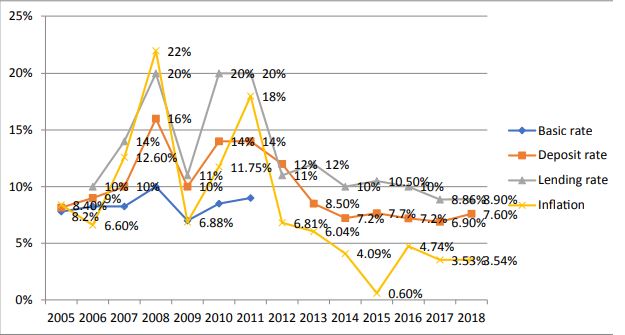

This research paper provides evidence that the market risk potential has decreased in 2015-2017 post-low inflation period (looking again figure 2-equity beta mean values), while the Figure 4 also suggests that the credit growth rate increased in 2016 and slightly decrease in later years (2017- 2018). It means that the local economy is trying to control credit growth reasonably, however we need to analyze risk factors more carefully to reduce more market risk. Deposit and lending interest rates in the past 12 years (2005-2018) in Vietnam are shown in figure 5.

Last but not least, different from banking industry, as it generates the result that the risk level became lower in the post-low inflation period, the government and relevant bodies such as Ministry of Finance and State Bank of Vietnam need to consider proper policies (including a combination of fiscal, monetary, exchange rate and price control policies) aiming to reduce/control the risk better and hence, help the stock market as well as the whole economy become more stable in next development stage.

Finally, this study opens some new directions for further researches in risk control policies in bank system as well as in the whole economy. For instance, how increasing inflation and deflation affects the risk level of stock investment industry and how much inflation is sufficient for financial system and economic development.

Figure 2: Statistics of Market risk (beta) in VN stock investment industry in the post – low inflation period 2015-2017 compared to the financial crisis 2007-2009.

Figure 3: GDP growth rate past 10 years (2007-2018) in Vietnam.

Figure 4: Loan/Credit growth rate in the past years (2012-2018) in Vietnam.

Figure 5: Deposit and lending interest rates in the past 12 years (2005-2018) in Vietnam.

Acknowledgements

I would like to take this opportunity to express my warm thanks to Board of Editors and Colleagues at Citibank – HCMC, SCB and BIDV-HCMC, Dr. Chen and Dr. Yu Hai-Chin at Chung Yuan Christian University for class lectures, also Dr Chet Borucki, Dr Jay and my ex-Corporate Governance sensei, Dr. Shingo Takahashi at International University of Japan. My sincere thanks are for the editorial office, for their work during my research. Also, my warm thanks are for Dr. Ngo Huong, Dr. Ho Dieu, Dr. Ly H. Anh, Dr Nguyen V. Phuc, Dr Le Si Dong and my lecturers at Banking University-HCMC, Viet Nam for their help.

Lastly, thank you very much for my family, colleagues, and brother in assisting convenient conditions for my research paper.

Martin K, Sweder VW (2012) On Risk, leverage and banks: Do highly leveraged banks take on excessive risk? Discussion Paper TI 12-022/2/ DSF31, Tinbergen Institute.[ Ref ]

Najeb MHM (2013) The Impact of Stock Market Performance upon Economic Growth, International Journal of Economics and Financial Issues 3: 788-798.[ Ref ]

Yener A, Leonardo G, David MI (2014) Does Monetary Policy Affect Bank Risk? International Journal of Central Banking 10: 95-135.[ Ref ]

Emilios A (2015) Bank Leverage Ratios and Financial Stability: A Micro- and Macroprudential Perspective. Working Paper No 849, Levy Economics Institute.[ Ref ]

Atousa G, Shima S (2015) The Relationship Between Life Insurance Demand and Economic Growth in Iran. Iranian Journal of Risk and Insurance 1: 111-131.[ Ref ]

Gunarathna V (2016) How does Financial Leverage Affect Financial Risk? An Empirical Study in Sri Lanka. Amity Journal of Finance 1: 57-66.[ Ref ]

Aykut E (2016) The Effect of Credit and Market Risk on Bank Performance: Evidence from Turkey. International Journal of Economics and Financial Issues 6: 427-434.[ Ref ]

Riet AV (2017) The ECB’s Fight against Low Inflation: On the Effects of Ultra-Low Interest Rates. International Journal of Financial Studies.[ Ref ]

Hami M (2017) The Effect of Inflation on Financial Development Indicators in Iran. Studies in Business and Economics 12: 53-62.[ Ref ]

Chizoba PE, Eze OR, Nwite SC (2018) Effect of Inflation Rate on Insurance Penetration of Nigerian Insurance Industry. International Journal of Research of Finance and Economics.[ Ref ]

Miguel ATZ, Francisco VM, Victor HTP (2018) Effects of inflation on financial sector performance: New evidence from panel quantile regressions. Investigation Economica 1: 94-129.[ Ref ]

Chatterjea A, Jerian JA, Jarrow RA (2001) Market Manipulation and Corporate Finance: A new Perspectives. 1994 Annual Meeting Review, SouthWestern Finance Association, Texas, USA.[ Ref ]

DeGennaro RP, Kim S (2003) The CAPM and Beta in an Imperfect Market. SSRN Working paper series.[ Ref ]

Galagedera DUA (2007) An alternative perspective on the relationship between downside beta and CAPM beta. Emerging Markets Review.[ Ref ]

Ang A, Chen J (2007) CAPM Over the Long Run: 1926-2001. Journal of Empirical Finance ADB and Viet Nam Fact Sheet.[ Ref ]

http://www.ifc.org/ifcext/mekongpsdf.nsf/Content/PSDP22[ Ref ]

http://www.construction-int.com/article/vietnam-construction-market.html[ Ref ]

http://fia.mpi.gov.vn/Default.aspx?ctl=Article&MenuID=170&aID=185&PageSize=10&Page=0[ Ref ]

http://kientruc.vn/tin_trong_nuoc/nganh-bat-dong-san-rui-ro-va-co-hoi/4881.html[ Ref ]

http://www.bbc.co.uk/vietnamese/vietnam/story/2008/12/081226_vietnam_gdp_down.shtml[ Ref ]

http://www.mofa.gov.vn/vi/[ Ref ]

https://www.ceicdata.com/en/indicator/vietnam/real-gdp-growth[ Ref ]